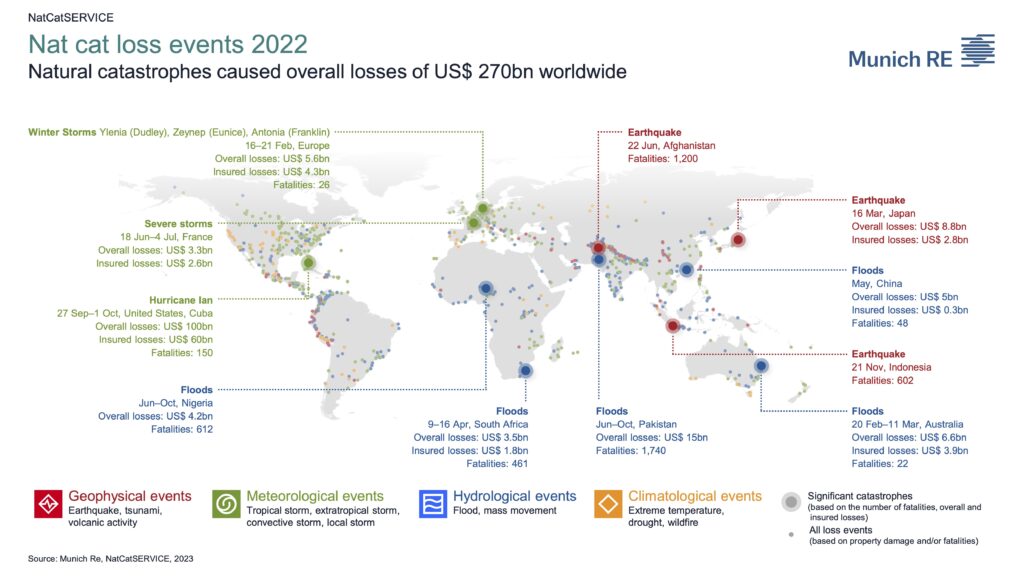

With overall losses of around US$270bn (US$320bn in 2021) and insured losses of roughly US$120bn (US$120bn in 2021), 2022 joins the recent run of years with high losses due to natural disasters.

Overall losses were close to the average for the last five years, while insured losses were significantly above average (2017-2021: US$97bn), according to Munich Re.

Ernst Rauch, chief climate scientist at Munich Re, said, “Two factors should be kept in mind when considering the 2022 natural disaster figures. First, we are experiencing La Niña conditions for the third year in a row. This increases the likelihood of hurricanes in North America, floods in Australia, drought and heatwaves in China, and heavier monsoon rains in parts of South Asia. At the same time, climate change is tending to increase weather extremes, with the result that the effects sometimes complement each other.”

Worst natural disasters in 2022

Hurricane Ian was responsible for more than one-third of overall losses and roughly half of insured losses worldwide. This powerful tropical cyclone made landfall on the west coast of Florida in September with wind speeds of almost 250km/h (150mph). Only four other storms on record have been stronger when making landfall on the US mainland, while some others were of a similar strength to Ian. According to provisional estimates, it caused overall losses of around US$100bn, of which US$60bn was insured (not including NFIP2). In terms of insured losses adjusted for inflation, Ian was the second-costliest tropical cyclone on record after Hurricane Katrina in 2005.

The year’s second costliest and greatest humanitarian disaster was severe flooding in Pakistan resulting from record-breaking monsoon rainfall. In August, rainfall there was between five and seven times heavier than usual. Accelerated glacier melt as a result of the high temperatures significantly increased the flooding. At least 1,700 people were killed. Direct losses are estimated to be at least US$15bn – an enormous amount given the size of the country’s GDP. Almost nothing was insured, and countless people lost all their belongings. Researchers estimate that the intensity of an event of this kind has already increased by half because of climate change, compared with a world without global warming, and that it will continue to rise in the future.

For insurers, the second-costliest single natural disaster in 2022 was flooding in the southeast of Australia in February and March. In the states of Queensland and New South Wales, extreme rainfall led to countless flash floods and severe river flooding. Numerous residents had to be rescued from their homes by boat or helicopter. The floods also affected the major population centers of Brisbane and Sydney. Of the overall losses of approximately US$6.6bn, just under US$4bn was insured. In October, torrential rainfall again resulted in disastrous flooding in the southeast of the country. However, losses were not as severe as those at the start of the year. Overall, floods in Australia caused losses of US$8.1bn last year, of which US$4.7bn was insured.