Dr Clyde Fraisse, EnsoAg founder and professor of agrometeorology at the University of Florida, looks at how a weather index-based insurance tool is helping farmers in Paraguay mitigate risk associated with drought.

Climate plays an important role in the production risks that farmers face. Adverse climate conditions can set the stage for crop failures associated with either a lack of, or an excess of, rainfall, as well as the incidence of pests and diseases. Farmers in Paraguay remember well the 2011-2012 cropping season, when an extreme drought affecting the country that year caused the Paraguayan government to declare a state of food security emergency on January 17, 2012.

Crop insurance is one of the risk management tools available to farmers that covers crop losses caused by adverse weather. An alternative to traditional insurance products is index-based insurance, which shows promise for addressing weather-related risks. It removes some of the high costs of traditional insurance by estimating yield losses rather than requiring field visits to directly measure yield on individual farms. To help small growers in Paraguay mitigate risk associated with drought, the Tajy crop insurance company developed an improved weather index-based insurance with the support from the BID-FOMIN investment fund. This innovative index was developed by EnsoAg LLC, a startup company that provides weather- and climate-based solutions to the agricultural industry.

This micro-insurance project for small-holder farmers in Paraguay was initiated in 2016 and the first two years were dedicated to conducting in-depth research of the needs of farmers and designing the index. The insurance program was commercially pilot-tested during the last two cropping seasons with sesame growers in the Paraguay Department of de San Pedro. During the last season (2018-2019), a short-term drought caused losses for growers that planted short-cycle varieties in mid-October due to the occurrence of water stress during the flowering phase of the crop. Most of the affected farmers received a payment to cover the losses and the project captured the interest of farmers in neighboring departments, sesame trading companies and lenders.

The insurance program is now expanding to three additional departments (Concepción, Caaguazú and Caazapá) and will include coverage against excess rainfall during harvest and hail damage. The Tajy micro-insurance program includes agronomical workshops to improve crop production practices in the region, as well as financial education opportunities to help small farmers reduce financial risk.

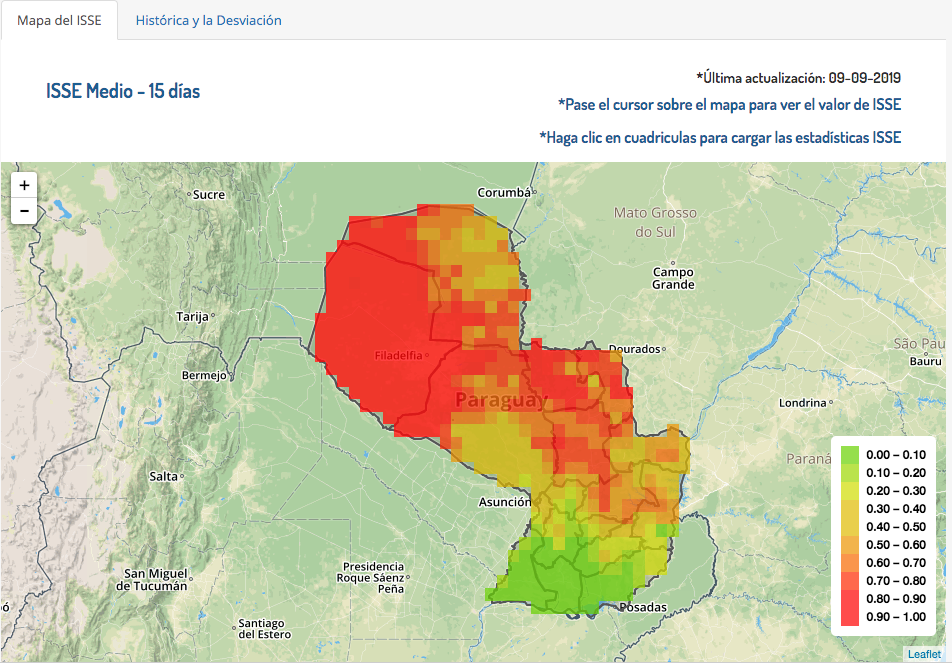

EnsoAg LLC developed an advanced web-based platform to provide farmers, cooperatives and the Tajy technical staff with access to the project weather stations network, as well as a variety of climate and weather monitoring and forecast products. Farmers can also check their current index accumulation and compare to insured thresholds. This information is also provided to growers via weekly SMS messages.

The most common index used in weather index-based insurances is rainfall. Payouts are triggered when the amount of rain during a specified window of time falls below a previously specified threshold. However, there are challenges associated with index-based insurance, particularly the discrepancy between actual on-farm losses and payouts. Specifically in the case of rainfall, crop yields are correlated not only to the total amount of rainfall during the growing season, but also to the distribution of rainfall events.

The EnsoAg index quantifies plant water stress on a daily basis and is significantly more effective to represent crop losses due to drought than indices that rely only on rainfall. This innovative index is based on a water balance that better characterizes crop water stress during the season. This drought severity index is accumulated during the season and payouts occur when it its accumulation overcomes triggers set for the season. Trigger values are based on the location of the fields, soil type, crop variety and planting date. Based on the successful outcome of this project, EnsoAg LLC is currently collaborating with reinsurance providers in the region to develop similar programs for other crops.